Mistakes when preparing import and export documents are always a "nightmare" for logistics and forwarder staff . Errors in documents not only lead to amendments and delays in customs clearance of goods, but can also lead to administrative fines, causing the import-export company to be placed on the risk list. Due to customs risks, a series of subsequent shipments will be "red channeled". ExtendMax wrote this guide in the spirit of sharing and hopes to help import and export documentation staff identify common mistakes and prevent them right from the initial stages of preparing customs clearance documents.

Wrong product name in Vietnamese #1

Declaring the name of goods in Vietnamese is quite easy, isn't it? However, in the practice of consulting for import-export companies, we realize that incorrect declaration, or unclear declaration of goods names in Vietnamese is a common mistake, causing a lot of problems and slowdowns. Delay in customs clearance leads to additional storage costs. Let's try to understand an example below to show you how important it is to declare the name of goods in Vietnamese.

The name of the imported product is "optical transceiver module", product image is as below. So how will you declare to prevent all the trouble?

We will declare the product name in Vietnamese as follows: "optical transceiver module, wired type, 100% brandnew product"

"wired type": emphasize that this type is wired, not a wireless device

"brandnew 100%": For electronic products, used goods are prohibited from import. You should clearly declare that the product is 100% new from the beginning to avoid being asked if it is new or not

Choose the wrong HS code #2

Hamonized System Codes (HS code) is a code in the Harmonized Commodity Description and Coding System of the World Customs Organization (WCO). HS code is always a very difficult field, whether for newcomers or experienced logistics staff. It is even more difficult when you lack specialized knowledge to understand the nature of imported or exported goods. We will show you a little tip to reduce errors.

As you have seen, HS code is the code in the harmonized system of the World Customs Organization of which Vietnam is a member. This system ensures classification and unification of management to facilitate trade. To ensure harmony, each country's HS code must be the same at the 6-digit level. That means you can base on the exporting country's HS code to get the first 6 numbers, you only have to choose the next 2 numbers according to Vietnam's HS code system. Choosing the HS code will be much easier, right? Take a look at the following example:

10-digit HS code of the exporting country: 8517620000

The corresponding 8-digit HS code of Vietnam is: 851762xx, in which the first 6 numbers are the same as the HS code of the exporting country. You only need to choose the last 2 numbers to match the nature of the goods, corresponding to the product code prescribed by Circular 31/2022/TT-BTTTT of the Ministry of Finance)

Fill in incorrect or missing information #3

Usually, filling in incorrect or missing information, or spelling errors can cause trouble. In some cases, it is not even allowed to amend the customs declaration. When preparing import and export documents, you should pay special attention to correctly and completely filling in the information on the electronic declaration that is not allowed to be additionally declared according to the provisions of Circular No. 38/2015/TT-BTC, include:

1) Declaration type code. Paying attention to the wrong type can be extremely troublesome.

2) Goods classification code (HS code)

3) Mode of transport code (ship / plane)

4) Name and code of the Customs office receiving the declaration

5) Name, address, business code of the importer/exporter

6) Code of customs brokerage agent

Inconsistent documents #4

Normally, export or import documents will include many types of documents. During the process of consulting for businesses, we realize that inconsistent documents are a fairly common error. This error does not come from document preparation but often comes from the transaction process between the buyer and the seller. Typical examples are inconsistent product descriptions and codes in the purchase invoice, purchase contract, and product catalog. In many cases, it can even lead to an administrative fine for declaring incorrect product codes or having to correct the declaration if you only rely on contract documents and invoices to complete the procedure.

To solve this problem, you can refer to the following methods:

1) Search for additional documents to "link" documents together for consistency

2) Based on the actual goods label, adjust the invoice and contract accordingly

Incorrect declaration of currency #5

This is a problem that even long-time employees in the logistics industry can still encounter. In most cases, the value of goods purchased and sold will be in USD. However, in some cases the value of the goods may be in GBP, EUR, DKK or another currency.

Solving this problem is very simple, you just need to pay a little more attention to form a habit before converting the value of goods into VND on the customs declaration.

Wrong declaration of country of origin #6

Country of origin is a very important issue, ensuring it is accurate because it is related to the tax payable for export or import shipments. Normally, the shipment will have a certificate of origin, this type of certificate is a guarantee for accurate declaration. However, not all cases can be completely based on the certificate of origin. You should also not rely on the seller's invoice, especially sellers who lack experience in foreign trade operations. Let's look at two typical examples below:

Example 1: A seller in Singapore exports information technology products to Vietnam. The set of documents does not have a CO certificate of origin (Certificate of Origin), the Invoice of the shipment declares the product to originate from Singapore.

In this case, we will ask a questionable question: Will the seller be confused between the exporting country (Singapore) and the country of origin? Normally, information technology products will originate from countries specializing in the production and processing of this type of product such as USA, Malaysia, China, Taiwan, Vietnam, and in some cases you may encounter the origin of India. . However, Singapore origin is extremely rare for ICT goods.

At that time, you should check with the seller again. Photos of actual product labels are always the highest guarantee to resolve this doubt.

Example 2: A shipment has a UK certificate of origin for a system (or a set of products including accessories), however the parts of that system are declared individually in the Invoice and are not recorded. origin note in Invoice.

If you believe in the CO certificate to declare UK origin for all parts of the system, or that product set, then sorry, you have lost your turn. Normally, components of information technology products such as power cords, connection cables... will be manufactured in China, Taiwan... then assembled into a product set in another country (in UK in this case).

Inappropriate invoice name #7

This case only often occurs in cases of import or export of goods in the form of non-payment H11 or H21. Many companies use an automated invoice system with a fixed invoice template named "Commercial Invoice". In this case, you may have trouble opening a declaration for the reason why the invoice name is "Commercial Invoice" but opening a declaration of "non-payment" type H11 or H21 ?

If you know the cause, the solution is quite easy. You just need to ask the exporter to correct the invoice to "Proforma Invoice", or "Customs Invoice", or "Non-commercial Invoice" or simply "Invoice".

Contract, Invoice missing signature #8

As you know, there are many companies that print commercial invoices and purchase orders from automated systems, so there are no signatures and seals. This may be quite new to some Vietnam officials in government agencies and you may be suspected of altering invalid documents or invoices or purchase orders (POs). Therefore, to ensure transparency in all cases, you should ask the exporter to sign the invoice and purchase contract. The addition of this signature should be prepared before shipment.

Clause 3, Article 43 of the Enterprise Law 2020 stipulates "Enterprises use seals in transactions in accordance with the provisions of law". This means that seals must only be used when required by law. For example, used in forms prescribed by the state with the "signature, stamp" section at the end of the form or used in accounting documents according to accounting laws. A commercial contract is a type of document whose form is not prescribed by law, which means that businesses can only use a signature, without needing to stamp the contract. However, this is still quite new to some officials of state management agencies. Therefore, you should also ask both import and export parties to stamp the contract for convenience when using the set of documents to apply for import and export licenses and quality inspection registration papers.

In fact, we have recorded many cases of unsuccessful applications for quality inspection registration due to invoices or contracts lacking signatures or seals.

Wrong declaration of product model #9

Declaring the wrong product code is a serious error, especially when the shipment is inspected. This error is a potential risk leading to large administrative fines and also prolongs customs clearance time. Once again, we recommend that you do not completely rely on purchase invoices and orders/contracts to declare product codes.

Always check the actual product label! However, don't be subjective with the product labels you have!

Why so? Let's look at an example of a product label below:

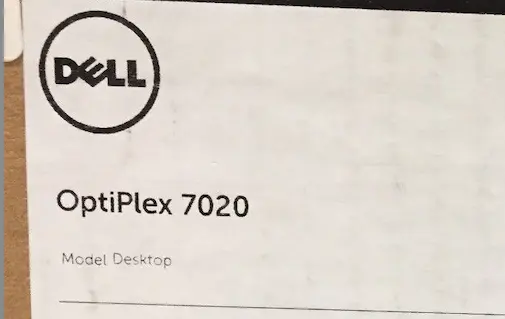

You see Model Desktop and Optiplex 7020 printed on the box, right?

Does that mean the product model is Optiplex 7020?

Our answer is: Probably not correct.

Now let's open the box and look at the label on the device

Surprisingly, you will see some numbers. So what does each number mean?

Normally, some manufacturers will use many different numbers to identify products, including:

Marketing Model Name (MMN): is the product identification number used for sales. For this specific example, the MMN is "Optiplex 7020 SFF"

Regulatory Model Name (MMN): is an identification number to serve testing and certification of conformity in parts of the world. In the picture on the right, "Reg Model" is RMN

Part Number or Reg Type: Is a specific configuration of a product within the same model, there may be slight differences in the case or accessories...

For the above case, you can use MMN, or RMN, or Reg Type, as long as this name is connected and consistent in all import and export documents. We recommend using RMN so that documents are consistent with the quality inspection registration and future certificate of conformity.

Opening declaration without license #10

Opening a customs declaration without an import-export license (for example, a civil cryptography product import-export license) or without a product quality inspection registration (PQIR) is a mistake that many experienced document staff also make. may encounter. This mistake can lead to an administrative fine of 30,000,000 VND ~ 50,000,000 VND, but this mistake is very difficult to avoid. Therefore, this is the problem that makes many service companies in the logistics industry "falter".

As you know, Vietnam has nearly 20 ministries under the Government with an equivalent number of group 2 goods, the list of goods requiring a license within the scope of responsibility of each governing ministry. At the same time, there is currently no comprehensive list where specialized policies applicable to all types of products can be looked up. In addition, each customs service company or import-export employee usually only specializes in a few types of goods and is only capable of mastering the regulations of a few types of goods. For ExtendMax, we can be proud to be Vietnam's leading expert in the field of specialized policies for information technology products. But if you ask us about another industry, such as textiles and garments, it will be difficult for us to advise you effectively.

Therefore, carefully learning about specialized policies is extremely important. ExtendMax recommends that you find experts in the industry to import for accurate, reliable guidance. Sometimes following online advice is effective, but you need to check and compare information from many different sources to draw valid conclusions.

Follow us via FB FanPage or LinkedIn to stay updated with the latest information

Please leave a comment and share the article if you find it useful in your work

↓ ↓ ↓ ↓ ↓ ↓ ↓